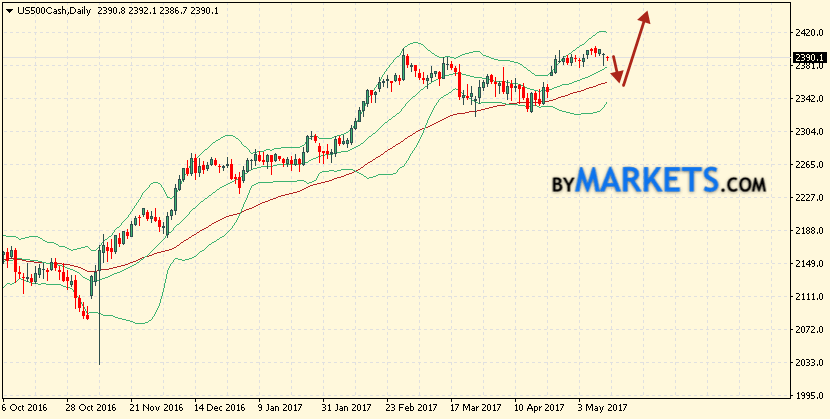

Stock index S&P 500 completes the trading week at the level of 2390.1. The S&P 500 is trading above the moving average with a period of 55, indicating a bullish trend for the S&P 500. At this point, the stock index moves near the middle border of the Bollinger Bands indicator bars. A correction to the moving average with a period of 55 near the level of 2360.0 is expected, where again we should expect an attempt to continue the growth and development of the bullish trend for the S&P 500 with the first target near the level of 2450.0.

S&P 500 weekly forecast on May 15 — 19, 2017

The conservative shopping area is located near the lower border of the Bollinger Bands indicator bars at 2340.0. The abolition of the continuation of the growth of the S&P 500 will be a breakdown of the moving average with a period of 55, as well as the lower border of the indicator bands and the closing of the quotations of the exchange index below the area of 2300.0, which indicates a change in the trend in favor of the bearish over the S&P 500. In the event of a breakdown of the upper boundary of the indicator bands Acceleration of the growth of the exchange index in the area above the level of 2450.0.