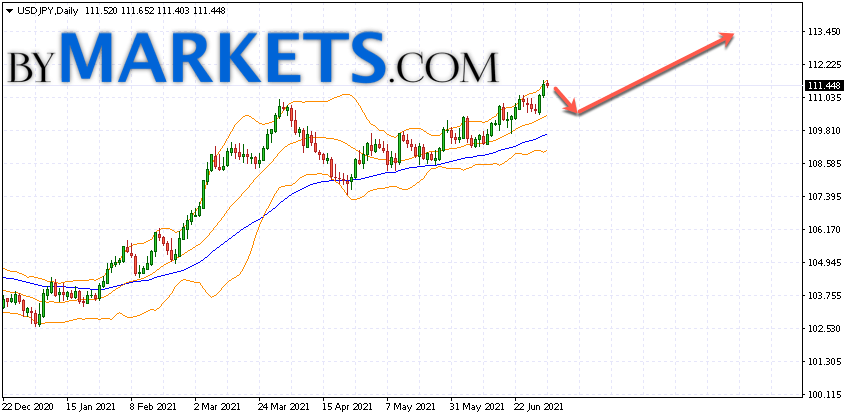

Currency USD/JPY is trading at 111.44. Quotes of the pair are trading above the moving average with a period of 55. This indicates the presence of a bullish trend for the pair Dollar/Yen. At the moment, the pair quotes are moving near the upper border of the Bollinger Bands indicator bars.

USD/JPY weekly forecast on July 9 — 11, 2021

As part of the forecast, the Dollar/Yen pair is expected to test the level of 110.40. Where can we expect an attempt to continue the growth of the USD/JPY pair and the further development of the upward trend. The purpose of this movement is the area near the level of 113.40. The conservative buying area for the USD/JPY pair is located near the lower border of the Bollinger Bands indicator strip at 109.10.

Cancellation of the option to continue the growth of the Dollar/Yen pair will be a breakdown of the area of the lower border of the Bollinger Bands indicator bars. As well as the moving average with a period of 55 and closing of quotations of the pair below the 104.70 area. This will indicate a change in the current trend in favor of the bearish for USD/JPY. In the event of a breakdown of the upper border of the Bollinger Bands indicator bands, one should expect an acceleration of growth.

USD/JPY weekly forecast on July 9 — 11, 2021 suggests a test level of 110.40. Further, growth is expected to continue to the area above the level of 113.40. The conservative area for buying is located area of 109.10. The cancellation of the growth option for the USD/JPY pair will be the breakdown of the level of 104.70. In this case, we should expect a continuation of the fall.