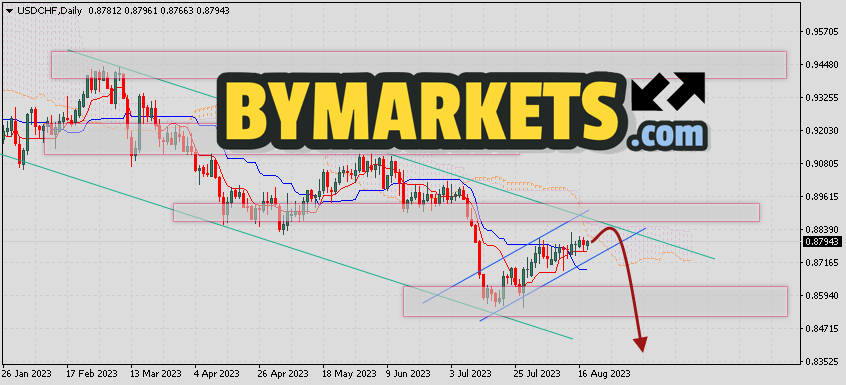

Currency pair US Dollar to Swiss Franc USD/CHF completes the trading week near the level of 0.8794. The pair is trading below the lower border of the Cloud indicator Ichimoku Kinko Hyo. This indicates the presence of a bearish trend in the Dollar Franc pair. In the current trading week, a test of the upper border of the Cloud of the Ichimoku Kinko Hyo indicator near the level of 0.8835 is expected. Where should we expect an attempt to rebound down and further fall of the pair with a potential target near the level of 0.8385.

Dollar Franc Prediction August 21 — 25, 2022

An additional signal in favor of the fall of the USD/CHF pair in the current trading week will be a test of the resistance level on the USD/CHF price chart. The second signal will be a rebound from the upper border of the bearish channel. Earlier, a weak signal was received for buying the Dollar Franc pair. The signal was formed due to the crossing of the signal lines at the level of 0.8735.

Cancellation of the option of falling quotes of the pair will be a breakdown of the upper boundary of the Ichimoku Kinko Hyo Cloud with the closing of quotes above the area of 0.8965. This will indicate a change in the bearish trend in favor of the bullish trend and continued growth. It is worth expecting an acceleration in the fall of USD/CHF with a breakdown of the support area and closing of quotes below the level of 0.8695, which will indicate a breakdown of the lower border of the bullish correction channel.

Dollar Franc Prediction August 21 — 25, 2022 suggests an attempt to develop a correction to the level of 0.8835. Where should we expect a rebound upwards and the continuation of the fall of the pair with a potential target near the level of 0.8385. A test of the resistance level on the price chart will come out in favor of the decline. Cancellation of the option of falling of the currency pair will be a strong growth and a breakdown of the area of 0.8965. In this case, we should expect the pair to continue to rise with the target above the level of 0.9345.